cares act stimulus check tax implications

Cares act stimulus check tax implications. Corporate alternative minimum tax was repealed with the tax cuts and jobs act though some corporate taxpayers still had minimum tax credits carrying forward under the alternative minimum tax regime.

Check Your Balance Coronavirus Stimulus Money Starts To Flow Into Bank Accounts

Many people anticipate receiving the CARES Acts Economic Impact Payments Stimulus Checks.

. Now that its tax time business owners who took advantage of these programs will want to know how the CARES Act relief affects their taxes. For married couples filing joint returns the income limit to receive a stimulus check is 150000. You are eligible to get a stimulus check and will receive the FULL amount if you filed taxes and have an adjusted gross income of.

If taxable income is zero in 2020 the. If you had 50000 in income and had a 5000 tax deduction your deduction would reduce your taxable income by. However people should use the money to pay for basic expenses or otherwise stimulate the economy.

The 2017 Tax Cuts and Jobs Act limited NOLs arising after 2017 to 80 of taxable income and eliminated the ability the ability to carry NOLs back to prior years. It reduces your income which reduces the amount of tax you owe. Business Related Changes Net Operating Losses NOLs Changes the current tax law to permit a business with additional rules for pass-throughs to apply an NOL from tax years beginning in 2018 2019 or 2020 to be carried back for five years.

The Coronavirus Aid Relief and Economic Security CARES Act was signed into law by President Trump on 32720. It was suggested that 200500 billion would fund tax rebate checks to Americans who made between 2500 and 75000 in 2018 to help cover short-term costs via one or two payments of 6001200 per adult and 500 per child. Cares Act Stimulus Check Tax Implications.

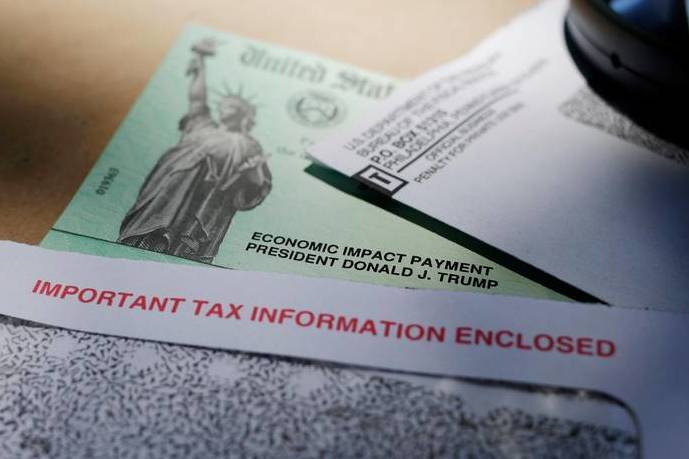

For NOLs arising in tax years beginning before 2021 the CARES Act allows taxpayers to carryback 100 of NOLs to the prior five tax years effectively delaying for carrybacks the 80 taxable income limitation and. Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to 1200 for individuals or 2400 for married couples. When the Coronavirus Aid Relief and Economic Security CARES Act was first passed in late March to help alleviate financial strains from the coronavirus pandemic coverage focused on stimulus checks and business loansThe CARES Act also changed many tax laws to be responsive to taxpayer needs and reversed some of the more onerous provisions that went.

The 2017 tax cuts and jobs act limited nols arising after 2017 to 80 of taxable income and eliminated the ability the ability to carry nols back to prior years. Information about the CARES Act Economic Impact Payments Stimulus Checks Posted on April 27 2020. Individual taxpayers will be receiving a 1200 paymentCouples will receive 2400If you have a qualifying child 16 and under each child will add an additional 500Once taxpayers reach an adjusted gross income threshold of 75000 150000 couple the refundable tax credit begins to phase out at a rate of 5 for every.

The House of Representatives passed the CASH Act however efforts for a 2000 second stimulus check are effectively dead. Up to 150000 if married and you filed a joint tax return. Senate on march 25 passed the cares acthr.

4 This provision allows an employer to contribute up to 5250 annually toward an employees student loans. The federal Coronavirus Aid Relief and Economic Security Act CARES ACT Consolidated Appropriations Act 2021 and American Rescue Plan Act of 2021 contained a number of tax provisions that impact the computation of taxable income for individuals and businesses modify eligibility for certain tax credits and provide assistance to taxpayers and businesses affected. According to an HR Block study of small business owners fewer than 1 in 3 28 are confident that they understand the financial andor tax implications of receiving aid as a.

Single filers who make more than 99000 and joint filers with income exceeding 198000 are not eligible for stimulus payments nor are those over 16 who are claimed as dependents by their parents which includes many college-aged people. If you had 50000 in income and had a 5000 tax deduction your deduction would reduce your taxable income by 5000. Tax Implications Of The 2020 Stimulus Check And CARES Act.

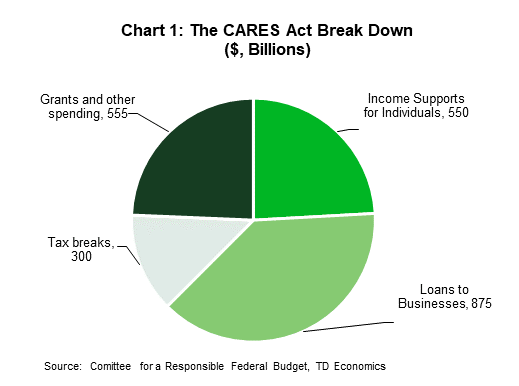

The CARES Act provides 22 trillion of economy-wide financial stimulus in the form of financial aid to individuals businesses nonprofit. Check our CARES Act Resource Page regularly for updates. Past Proposed Stimulus Measures.

If you were in the 12 percent tax bracket youd reduce your taxes owed by 600 12 percent of 5000. But evaluating these tax impacts can be daunting. Check out our Stimulus Check Calculator.

This round of stimulus is an advance on a tax credit people can get when filing their 2020 tax return. Stimulus Checks The check amount is based on adjusted gross income AGI oIf filing single and your AGI is 75000 or less oIf filing as head of household and your AGI is 112500 or less oIf married and AGI is 150000 or less oPayment is 1200 for. The CARES Act expanded deduction for charitable deductions for 25 of taxable income up from 10 before CARES Act for donations to public charities.

The stimulus check details are as follows. Plan provides that if your 2020 tax return is not filed and processed by the time the IRS starts processing your third. Parents also receive 500 for each qualifying child child must qualify for Child Tax Credit.

The 22 trillion stimulus package includes measures to help businesses hurt by the pandemic as well as direct payments to citizens who have been hurt by the pandemic. The stimulus checks arent taxable so dont report the money when filing taxes. The payment is excluded.

The third law enacted March 27 2020 is the Coronavirus Aid Relief and Economic Security Act the CARES Act or the Act which from a monetary-relief perspective dwarfs the prior two acts. Up to 112500 if you filed as head of household. The CARES Act passed in March created the first program that allowed companies to make tax-free contributions to their employees student debt and the new relief bill extends this provision for five years.

When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional payment for those who had dependent children. Up to 75000 if single or you filed taxes married filing separately. This payment was to help mitigate some financial burden families were facing when most businesses in the United States shut down as a result.

Updated March 11 2021. The Senate passed on the House-passed CASH Act which would have increased the second-round stimulus checks approved by the COVID-Related Tax Relief Act from 600 to 2000.

Reporting Cares Act Benefits On Taxes H R Block

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

3rd Stimulus Check Tax Filing Impact The Child Tax Credit And Other Faqs Abc7 Chicago

Understanding Economic Impact Payments And The Child Tax Credit National Alliance To End Homelessness

Second Stimulus Checks What Nonresidents Need To Know

The Impact Of The Cares Act On Economic Welfare Bfi

Stimulus Check Do You Have To Pay Tax On The Money Cbs News

Trump Signs Covid Relief Bill 600 Stimulus Checks Go Out This Week

The Impact Of The Cares Act On Economic Welfare Bfi

Faqs On Tax Returns And The Coronavirus

Irs Admits Mistake In Noncitizens Receiving 1 200 Coronavirus Stimulus Checks Npr

Coronavirus Irs Sends Stimulus Checks To Deceased Americans Warns Relatives Forgery Is A Federal Crime Abc7 San Francisco

The Cares Act Provides Material Support To Households And Businesses

His Name On Stimulus Checks Trump Sends A Gushing Letter To 90 Million People The Washington Post

Coronavirus Stimulus And Relief Program Guide Smartasset

What Is Fiscal Stimulus Forbes Advisor

Impact Of The Coronavirus Stimulus Checks On The Economy Julian Samora Research Institute Michigan State University

Tax Season 2021 Is Open And Comes With A Lot Of Issues The Washington Post

/GettyImages-471149471-de51e2b1c99c48b89b74f359788f2668.jpg)